RegTech, short for Regulatory Technology, has been making waves in the financial industry. As regulatory requirements become increasingly complex, financial institutions are turning to innovative solutions to streamline their compliance processes. In this blog post, we will explore the concept of Regulatory Technology, its significance in the finance sector, and how it is revolutionizing regulatory compliance.

What is RegTech?

RegTech refers to the use of technology, particularly advanced software, and data analytics, to facilitate compliance with regulatory requirements in the financial industry. It leverages innovative solutions to automate and streamline various compliance processes, making them more efficient and cost-effective.

Regulatory compliance has always been a critical aspect of the finance sector. Financial institutions are obligated to adhere to a wide range of regulations, including anti-money laundering (AML), Know Your Customer (KYC), data privacy, and cybersecurity. Traditionally, compliance processes have been manual, time-consuming, and resource-intensive. However, with the emergence of Regulatory Technology, organizations can leverage technology to enhance their compliance capabilities.

Key Features

RegTech solutions encompass a wide range of technologies and tools tailored to address specific compliance challenges. Here are some key features and benefits:

- Data Analytics: RegTech leverages data analytics to process and analyze vast amounts of financial and regulatory data. By extracting valuable insights, organizations can identify patterns, detect anomalies, and proactively mitigate risks.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms power advanced RegTech solutions, enabling them to learn from historical data and make accurate predictions. These technologies can automate compliance monitoring, risk assessments, and fraud detection.

- Blockchain Technology: Blockchain, a distributed ledger technology, provides transparency, immutability, and security to compliance processes. It facilitates secure data sharing, identity verification, and audit trails, ensuring regulatory compliance across multiple stakeholders.

- Cloud Computing: Cloud-based RegTech solutions offer scalability, flexibility, and accessibility. They enable organizations to centralize compliance data, streamline collaboration, and access compliance tools from anywhere, at any time.

- Regulator Collaboration: Some RegTech platforms promote collaboration between financial institutions and regulatory authorities. This collaboration facilitates regulatory reporting, information sharing, and a more streamlined compliance process.

The Importance and Key Benefits in the Financial Industry

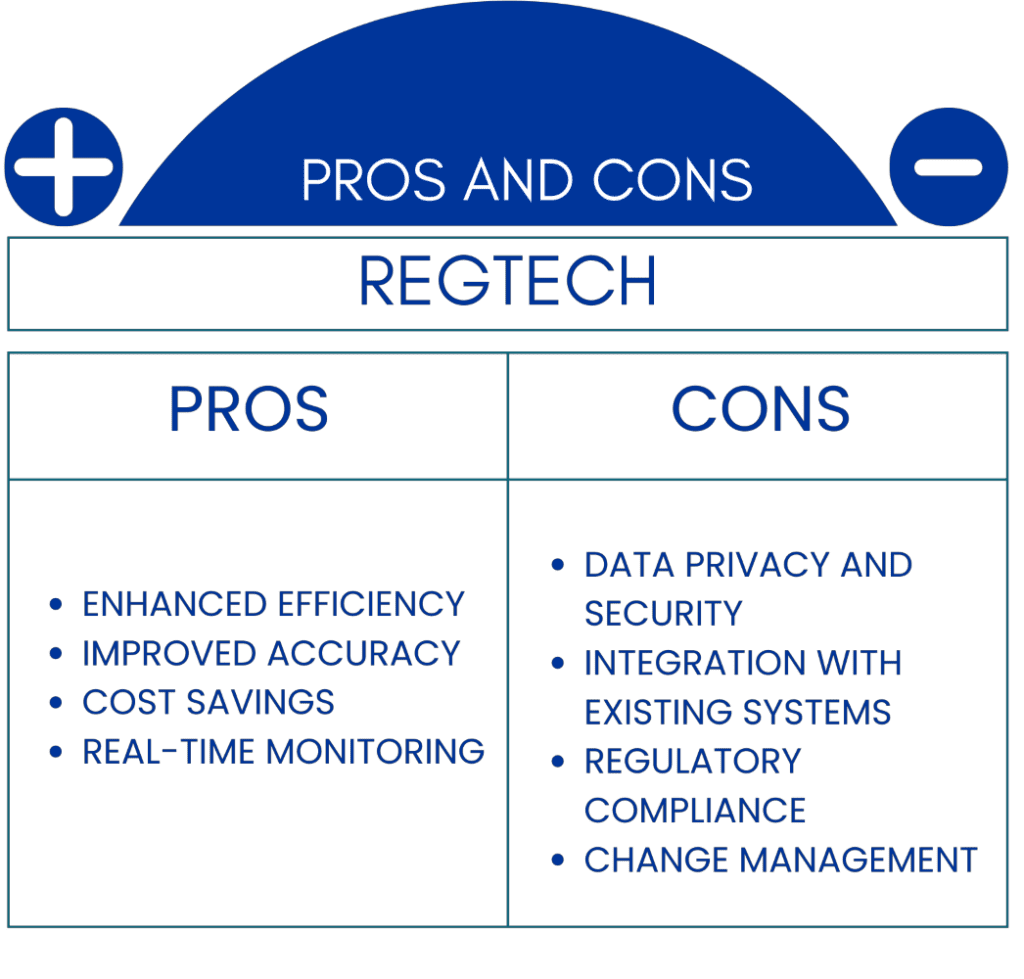

The financial industry operates in a highly regulated environment, and non-compliance can lead to severe consequences such as legal penalties, reputational damage, and loss of customer trust. RegTech plays a vital role in helping financial institutions navigate these complex regulatory landscapes more effectively.

- Enhanced Efficiency: RegTech solutions automate repetitive compliance tasks, such as data collection, verification, and reporting, reducing the need for manual intervention. This automation saves time and resources, enabling organizations to allocate their workforce to more strategic initiatives.

- Improved Accuracy: Manual compliance processes are prone to human errors, which can have significant consequences. RegTech solutions use advanced algorithms and data analytics to ensure accurate and consistent compliance, minimizing the risk of errors and non-compliance.

- Cost Savings: By streamlining compliance processes, RegTech solutions help financial institutions reduce operational costs associated with manual compliance efforts. Automation eliminates the need for extensive manpower, resulting in significant cost savings over time.

- Real-time Monitoring: RegTech solutions often incorporate real-time monitoring capabilities, enabling organizations to identify and address compliance issues promptly. This proactive approach minimizes the risk of regulatory breaches and allows for timely corrective actions.

Implementing RegTech: Challenges and Considerations

While the benefits of RegTech are compelling, implementing these solutions requires careful consideration and planning. Here are some challenges and considerations to keep in mind:

- Data Privacy and Security: As RegTech solutions deal with sensitive financial and personal data, organizations must prioritize data privacy and security. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial.

- Integration with Existing Systems: Integrating RegTech solutions with existing IT infrastructure and systems can be complex. Organizations must ensure compatibility, seamless data flow, and minimal disruption to ongoing operations.

- Regulatory Compliance: While RegTech solutions facilitate compliance, organizations must still ensure that the solutions themselves align with regulatory requirements. Regular audits and assessments are necessary to maintain compliance standards.

- Change Management: Implementing RegTech often involves significant organizational and cultural changes. Effective change management strategies, including employee training and stakeholder engagement, are essential for successful adoption.

RegTech: Empowering Financial Institutions in the Fight Against Financial Crime

In the complex world of finance, combating financial crime is a top priority for financial institutions. RegTech emerges as a valuable tool, empowering these institutions to strengthen their defenses and protect against illicit activities. Let’s explore some key capabilities that make RegTech a powerful ally in this battle:

- Pattern Recognition: RegTech solutions excel at analyzing vast amounts of data, enabling the detection of patterns that may indicate suspicious activities. By identifying potential red flags, RegTech enhances the ability of financial institutions to mitigate risks and maintain compliance.

- Risk Assessment: RegTech leverages advanced algorithms to assess and prioritize risks. These algorithms analyze diverse data sources, assisting financial institutions in identifying areas of vulnerability and taking proactive measures to mitigate potential risks.

- Real-Time Monitoring: With real-time monitoring capabilities, RegTech enables financial institutions to swiftly identify and respond to anomalies in financial transactions. This timely detection helps mitigate the impact of fraudulent activities and strengthens overall security.

- Collaboration and Information Sharing: RegTech fosters collaboration among financial institutions and regulatory authorities, facilitating the exchange of information and insights. This collective intelligence enhances the industry’s ability to combat financial crime by staying informed about emerging trends and best practices.

Together, financial institutions and RegTech form a partnership aimed at ensuring the integrity of the finance industry. By leveraging the capabilities of RegTech solutions, these institutions enhance their ability to detect and prevent financial crime, safeguarding the interests of their customers and maintaining the trust and stability of the financial ecosystem.

In the ongoing fight against financial crime, RegTech plays a vital role, providing financial institutions with valuable tools and insights to navigate the ever-evolving landscape of compliance and security.

Future Trends in RegTech

RegTech is an ever-evolving field, and several trends are shaping its future:

- Advanced Analytics: RegTech solutions will continue to leverage advanced analytics techniques, such as natural language processing and sentiment analysis, to extract valuable insights from unstructured data sources.

- Internet of Things (IoT) Integration: IoT devices generate vast amounts of data, which can be leveraged for compliance purposes. RegTech solutions will increasingly incorporate IoT integration to monitor and ensure compliance in real-time.

- Regulatory Sandboxes: Regulatory authorities are establishing regulatory sandboxes to foster innovation in the RegTech space. These sandboxes provide a controlled environment for testing and validating new RegTech solutions before wider adoption.

Conclusion

RegTech is transforming the way financial institutions approach regulatory compliance. By harnessing the power of technology, organizations can streamline their compliance processes, enhance efficiency, and mitigate regulatory risks. As the financial industry continues to navigate complex regulatory landscapes, it will play an increasingly pivotal role in driving compliance excellence.

FAQs

1. What are the main benefits of using RegTech in the finance sector? RegTech offers enhanced efficiency, improved accuracy, cost savings, and real-time monitoring capabilities in the finance sector. It automates compliance tasks, reduces errors, lowers operational costs, and helps identify and address compliance issues promptly.

2. How does RegTech leverage data analytics? RegTech leverages data analytics to process and analyze financial and regulatory data. It extracts insights, identifies patterns, detects anomalies, and facilitates risk assessment and fraud detection.

3. What role does AI and ML play in RegTech? AI and ML algorithms power advanced RegTech solutions, enabling them to learn from historical data and make accurate predictions. These technologies automate compliance monitoring, risk assessments, and fraud detection.

4. How does blockchain technology benefit RegTech? Blockchain provides transparency, immutability, and security to compliance processes. It facilitates secure data sharing, identity verification, and audit trails, ensuring regulatory compliance across multiple stakeholders.

5. What are the future trends in RegTech? Future trends in RegTech include advanced analytics, IoT integration, and the establishment of regulatory sandboxes to foster innovation in the field. These trends will further enhance compliance capabilities and drive regulatory excellence.

Additional Resources

Canadian Centre for Cyber Security (CCCS) – The CCCS provides guidance and resources on cybersecurity best practices for Canadian organizations, including information on RegTech solutions and cybersecurity frameworks.

Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) – The official website of FINTRAC provides information on regulatory requirements and guidance related to anti-money laundering and counter-terrorist financing in Canada.

Wealth Solutions Hub Articles: